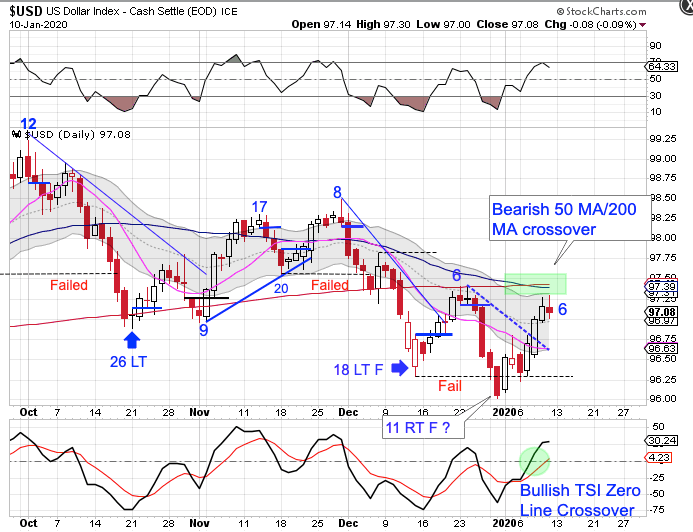

The Dollar

The dollar printed its lowest point on day 11. That should have been too early for a daily cycle low to form.

However with the currency manipulation and the conflict in the Mideast it certainly appears as if an early DCL formed. The dollar formed a swing low and closed above the 10 day MA. It is running into resistance at the converging 50 day MA and the 200 day MA. A close above these two moving averages would confirm that day 11 was an early DCL. The dollar is in a daily downtrend. It will remain in its daily downtrend unless it closes back above the upper daily cycle band.

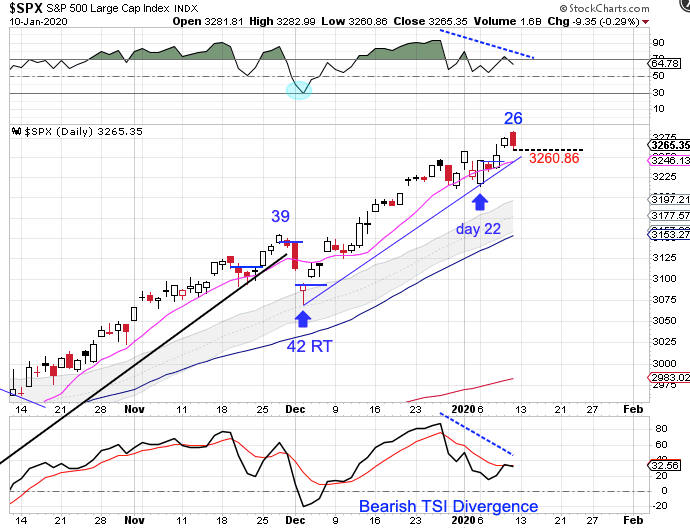

Stocks

Stocks printed a new daily cycle high on Friday.

Friday was day 26 for the daily cycle. The new high on Friday locks in a right translated daily cycle formation which aligns with stocks begin in a daily uptrend. There are bearish divergences developing on the oscillators, which often precede a cycle decline. Stocks did printed a bearish candle on Friday, which eases the parameters for forming a daily swing high. A break below 3260.86 will form a daily swing high. Then a break below the daily cycle trend line will signal the daily cycle decline. Stocks are in a daily uptrend. Stocks will remain in their daily uptrend unless they close below the lower daily cycle band.

"cycle" - Google News

January 13, 2020 at 07:00AM

https://ift.tt/36PT6ED

Cycle Trading: The Weekend Report Preview - FXStreet

"cycle" - Google News

https://ift.tt/32MWqxP

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Cycle Trading: The Weekend Report Preview - FXStreet"

Post a Comment