A new bull market is now well underway, fueled by accelerated computing infrastructure, artificial intelligence (AI) systems built atop that infrastructure, and elevated interest among governments around the world in "re-shoring" chip manufacturing onto their soil. Intel (NASDAQ: INTC) appears well-positioned to be a top beneficiary from these growth trends.

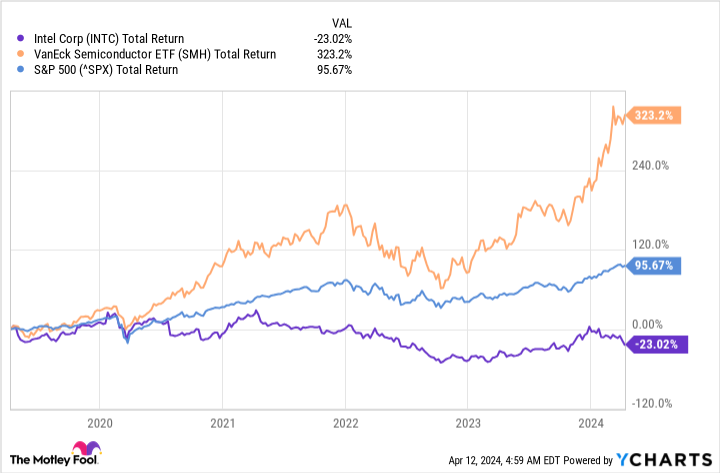

Despite this apparent enthusiasm, the stock has far underperformed both the broad market and other leading chip stocks.

The company seemed to have been rebuilding some momentum in the last year, but an epically bad financial update on its manufacturing segment has many investors taking a hard second look.

The situation at Intel

Intel is trying to become the "national hero" in U.S. chip manufacturing. It has scooped up billions of dollars in grants and tax incentives from the U.S. CHIPS Act, similar assistance from the European Union's Chips Act, and private investment from infrastructure investor Brookfield.

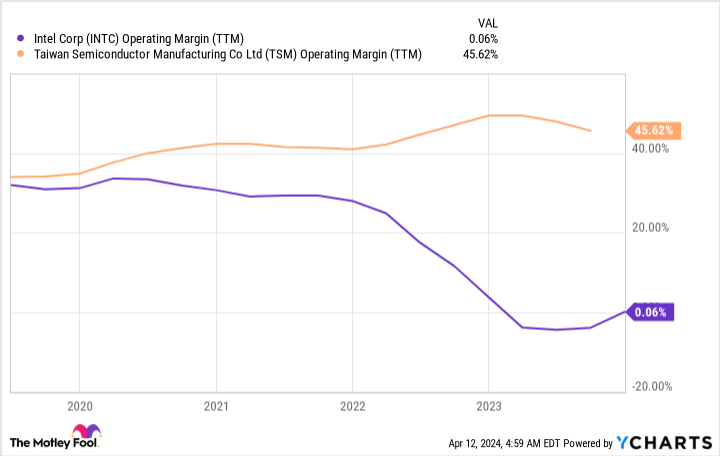

The reason Intel has narrowed its focus on revamping its chipmaking is because of the dominance of Taiwan Semiconductor Manufacturing (NYSE: TSM), the giant third-party chip foundry that today makes some 90% of the world's most advanced semiconductors (including many of Intel's most advanced chips). Many investors are worried about the implications of a possible invasion of Taiwan by China. Plus, Western governments want more chip manufacturing resilience, which is really another way of saying they'd like more semiconductor manufacturing relocated outside of China's potential sphere of influence, and onto their own shores.

So Intel is pursuing those government funds in order to build a manufacturing infrastructure that can compete with TSMC, and offer top chip designers like Nvidia, Advanced Micro Devices, and Qualcomm an alternative fab shop.

The glaring problem, though, is Intel just confirmed what some investors always feared: Its manufacturing operation (a business segment that is now called "Intel Foundry") operates at a steep loss. It generated a $7 billion operating loss in 2023 on Intel Foundry revenue of $18.9 billion. (Most of those sales come from Intel's "Product" segment, which has been reshuffled to report as a non-manufacturing design house.)

This isn't a new development, either. Under these new reporting standards, Intel revealed that even during the previous chipmaking boom, Foundry generated operating losses of $5.1 billion in 2021 and $5.2 billion in 2022.

Is this chip manufacturing funding, or a bailout?

Intel management has an imprecise timeline for getting the Foundry segment out of the deep hole it's in, although CEO Pat Gelsinger said the unit should reach breakeven within the next few years. That isn't exactly heartwarming news. While Intel capitalizes on government funds to fix its business model issues, there are other semiconductor manufacturers (including TSMC) that already operate at healthy profits.

Of course, one way to look at this is that Intel is all upside from here on out as it solves problems and gets ample sums of money to build a robust chipmaking operation not located in Taiwan. But Intel isn't the only company getting government funds. So is TSMC. It was just awarded up to $6.6 billion in direct funding from the U.S. CHIPS Act, plus another $5 billion in loans and other tax incentives, to bolster and expand the facilities it is building in Arizona.

Given the mountain Intel needs to climb, it isn't even a cheap stock. It trades for 28 times 2024 expected earnings per share (EPS), and more than 16 times 2025 expected EPS. Also important to remember, EPS excludes the hefty capital expenditures the company will need to make over the next few years, expenditures that will certainly exceed the government assistance it's getting.

In short, Intel is a really hard stock to own right now. Investors who want to bet on a rebound should size any position in this company accordingly. Meanwhile, there are lots of other semiconductor businesses in really good shape right now as this bull market gets rolling.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Nicholas Rossolillo and his clients have positions in Advanced Micro Devices, Nvidia, and Qualcomm. The Motley Fool has positions in and recommends Advanced Micro Devices, Brookfield Corporation, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Brookfield and Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Intel Just Revealed Why It Can't Split From Its Manufacturing Model and Why the Stock Is a Hold at Best was originally published by The Motley Fool

Read Again https://news.google.com/rss/articles/CBMiSmh0dHBzOi8vZmluYW5jZS55YWhvby5jb20vbmV3cy9pbnRlbC1qdXN0LXJldmVhbGVkLXdoeS1jYW50LTA4MTAwMDY4Ny5odG1s0gEA?oc=5Bagikan Berita Ini

0 Response to "Intel Just Revealed Why It Can't Split From Its Manufacturing Model and Why the Stock Is a Hold at Best - Yahoo Finance"

Post a Comment