Until a flu-like virus emerged halfway around the world, itaEURtms been three peaceful months since weaEURtmd seen a aEURoe1% up or down dayaEUR in stocks. As usual, the volatility inspired investors to reflect upon the advanced age (almost eleven years) of our current bull market.

To paraphrase the legendary rock band Chicago, does anybody really know what time it is in the rally right now? aEURoeLate cycleaEUR is a popular guess. But how late?

Did the streetlights just pop on, or is it 2am with money managers stumbling into their taxis and Ubers outside?

Most rallies donaEURtmt make it to eleven, but then again, most donaEURtmt follow financial crises either. As Carmen Reinhart and Kenneth Rogoff outlined in their unique read This Time Is Different: Eight Centuries of Financial Folly, the big meltdowns eventually give way to economic expansions that:

- Have less aEURoepopaEUR than standard-fare recoveries. The previous financial wounds take longer to heal, so the ensuing good times take a (long) while to get rolling. And,

- They last longer, too. Participants pace themselves and everyone worries about the next hangover. The calmer party has more longevity!

Yet I often hear from readers who are concerned that our decade-plus market rally is ready to end. I can appreciate the concern. After all, stock prices usually precede economic newsaEUR"drops precede recessions, bumps precede expansionsaEUR"and ten-plus years is a long time to go between recessions (regardless of their severity).

Fortunately, we donaEURtmt have to choose between safety and income. We can begin to position our retirement portfolio to sail along aEURoejust in caseaEUR the lights are about to come on with the revelers being sent to the streets.

Here are three late cycle income ideas to consider moving money into right now. Many of these were rare aEURoegreen tickersaEUR in the recent seas of red losses on most portfolio screens. Their impressive relative strength is a clue that these dividend havens will become quite popular as investors and money managers increasingly seek safety.

Late Cycle Dividend Play #1: aEURoeBargainaEUR Bonds

I know, bondsaEUR"how boring. Plus, havenaEURtmt bonds rallied like crazy across the board? Do they even pay enough to warrant our cash?

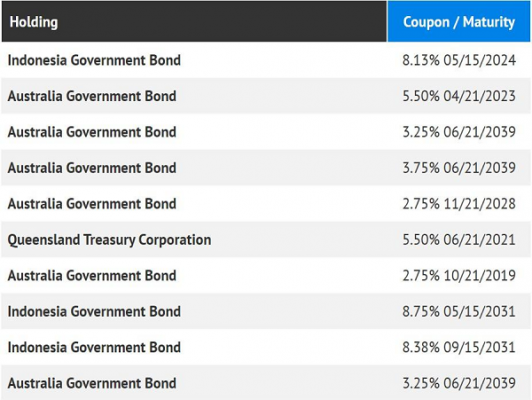

If you think that bonds pay less than 2% today, youaEURtmve been watching too much CNBC. Sure, most American aEURoepaperaEUR isnaEURtmt much more than a guarantee that youaEURtmll get your initial money back in two, ten or thirty years. But, if you know where to look, you can actually find secure bonds like these that yield up to 8.75%:

But wait, thereaEURtms more. You can buy this basket for just 90 cents on the dollar to its true valueaEUR"a 10% discount in other wordsaEUR"by simply purchasing the closed-end fund (CEF) that put this high-paying portfolio together. If you know where to look, of course.

This one-click purchase gives you a diversified monthly distribution that adds up to 7.6% per year. And if interest rates drop more (because, say, we creep into a recession) the fundaEURtms assets are going to increase in value. Lower rates will simply make its high, fixed rate holdings more popular.

Late Cycle Dividend Play #2: aEURoeBoringaEUR Landlords

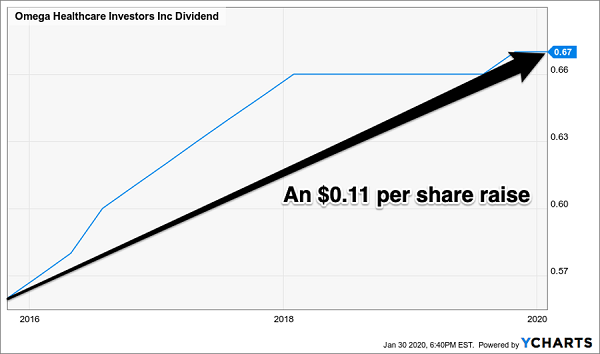

Is there any reason to ever sell a dividend like this?

An Ever-Rising Payout

If there is, my Contrarian Income Report subscribers and I havenaEURtmt found it yet. This ever-rising payout belongs to Omega Healthcare Investors (OHI), a real estate investment trust (REIT) that owns skilled-nursing facilities.

Extra rooms in these assisted-living properties are becoming increasingly difficult to come by. Within the decade, US demographics are going to result in a deficit in available SNF rooms (which is bad for baby boomers but great for OHI investors).

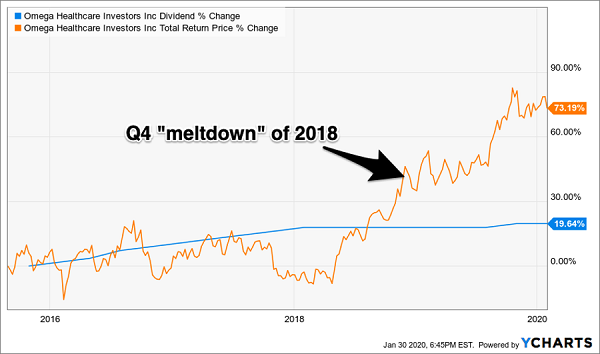

If youaEURtmre ever tempted to overtrade and potentially aEURoetimeaEUR the next downturn, let me point out a blip on our 73% total returns from this trade to put that in perspective. In the fourth quarter of 2018, the broader market completely melted down with the S&P 500 dropping almost 20%. It was aEURoenearly an official bear.aEUR Yet, big picture, it couldnaEURtmt have mattered less to OHI longs:

DonaEURtmt Let Permabears Scare You Out of Positions Like These

While the rest of the market tanked, OHI most decidedly did not. Not all REITs are as recession-proof as OHI, so make sure you consider the revenue model before you buy. Nuances in businesses, by the way, can also be the best way to buy yesteryearaEURtms favorite income stocks: Safe, reliable utilities.

Late Cycle Dividend Play #3: aEURoeBackdooraEUR Utility Plays

Utility stocks are perhaps the aEURoeoriginalaEUR dividend plays. ThereaEURtms nothing like monopoly status to guarantee reliable cash flow, after all.

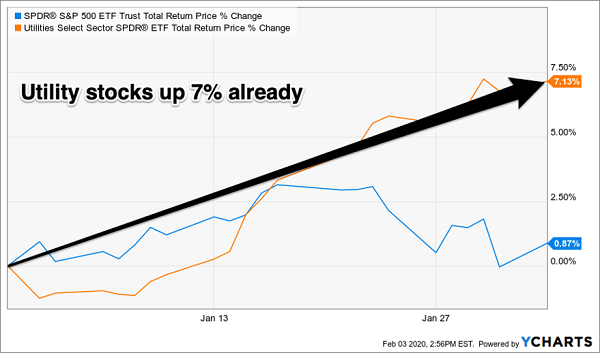

We are not the only income investors thinking about utilities, unfortunately. Year-to-date the Utilities Select SPDR ETF (XLU) has returned more than 7% while the S&P 500 has barely trod water:

A Popular Late-Cycle Income Idea

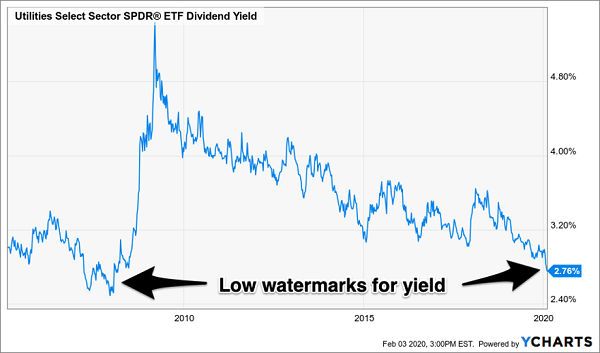

The problem with high prices, especially for those of us who donaEURtmt yet own the stock (or, in this case, ETF) is a lower yield. XLU hasnaEURtmt paid this little sinceaEUR"wait for itaEUR"early 2008:

XLU HasnaEURtmt Paid This Little in 12 Years

Ominous parallels aside, the 2.76% yield is a strong enough reason to avoid XLU and the aEURoefirst-levelaEUR utility stocks it holds. Plow a million bucks into this ETF and youaEURtmve got a diversified portfolio that pays just $27,600 per year. You could lose that in one trading session!

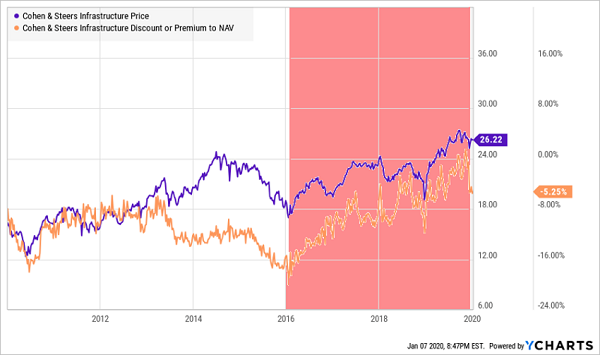

A better bet is a aEURoebackdooraEUR utility play such as the Cohen & Steers Infrastructure Fund (UTF). Unlike XLU, an ETF that usually trades for the aEURoepar valueaEUR of its underlying assets, UTF is a CEF which means it can often trade well below the value of its portfolio.

For example, I originally recommended UTF to my Contrarian Income Report subscribers four years ago to this day (happy anniversary, UTF!), when its price lagged its NAV (net asset value) by a fat $3+ per share, which represented an amazing 16% discount.

In other words, we found a way to buy blue-chip utility stocks for just 84 cents on the dollar. Over time, other investors learned about our aEURoesecretaEUR and bid UTFaEURtms price up towards its fair value:

A Backdoor Way to Play Utilities

aEURoePerfectaEUR Late Cycle Dividend Plays That Pay 10% Today

Our newest aEURoeperfectaEUR late cycle income play pays a safe 10%. ThataEURtms right. A secure 10%!

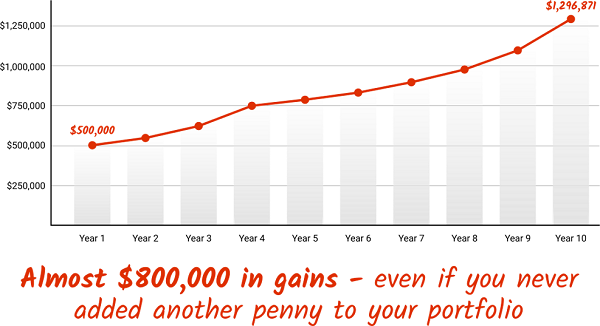

Put $50K into this stock and youaEURtmll see $5,000 per year in dividends. Or $50K in annual dividends on a relatively modest $500,000! You get the idea.

WhataEURtms the ticker? Well, thataEURtms what IaEURtmm here to show you today.

After years of keeping it my personal secret, IaEURtmm finally revealing myA aEURoePerfectaEUR Late Cycle Income Portfolio. A simple, proven, and time-tested strategy you can use to double, triple, even quadruple your incomeaEUR"almost immediately!

Plus, IaEURtmm also going to give you THREE specific investments you can buy right now forA MAXIMUM income combined with MAXIMUM stability!

This is a strategy I could easily charge thousands of dollars for.

But today, IaEURtmm handing you the keys to the kingdom right here on this page.

All youaEURtmve got to do is take action and implement what youaEURtmve discovered. If you want to take charge of your retirement income, you can easily build a portfolio which returns 10%+ per yearaEUR"without EVER having to withdraw from your savings.

Now, compare this to the S&P 500aEURtms 1.9% dividend and weaEURtmre talking about a $40,500 difference on a $500,000 portfolioaEUR"every single year!A ThataEURtms the sort of life-changing money that can provideA true security and freedom.

Best of all, as youaEURtmll see today, it only takes a few minutes to set up this vastly more profitable portfolio.

When I talk about the Perfect aEURoeLate CycleaEUR Income Portfolio, IaEURtmm speaking about a collection of safe dividend stocks and funds that:

- Pay you 7%, 8% or more consistently and predictablyaEUR"even if thereaEURtms a crisis, crash, or pullback.

- Give you a safe, secure, and steadyA incomeA of $10s of thousands per year in cashaEUR"notA just aEUR~paper gains.aEURtm

- Pay out exclusively from your investment incomeA andA NOTA require you to withdraw cash from your savings or assets.

- AvoidA overly complex, high-risk investmentsA that can wipe out decades of hard-earned money in a matter of weeks or months!

- Are simple to set up and simple to manageaEUR"so youaEURtmre not glued to your screen all day and you canA actuallyA enjoy life.

- Are backed up by a proven track-record of 10% total returns per year since inception.

As I mentioned, this was built from years of painstaking research, trial and error, and financial modelling. I designed it for my own personal portfolio and my desire to enjoy a large incomeaEUR

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

"cycle" - Google News

February 05, 2020 at 09:30PM

https://ift.tt/31rajSY

Late Cycle Investing: Dividend Stocks for 2020 and Beyond - Nasdaq

"cycle" - Google News

https://ift.tt/32MWqxP

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Late Cycle Investing: Dividend Stocks for 2020 and Beyond - Nasdaq"

Post a Comment