Point & Figure overview of SPX

Long term trend: The bull market which started in 2009 shows no sign of having run its course. A count taken on the long term P&F chart gives us a potential target as high as 4080. P&F does not predict time; only price. (no change)

Intermediate trend:Intermediate target minimum: 2620 – potential: 2360.

Important (known) cycles

I follow only a few cycles which I use in my analysis. This is complemented by the analysis of Erik Hadik (www.insiidetrack.com).

The 20-wk cycle most likely bottomed on 2/28. 80-d due 4/7-6/8; 40-wk 7/14; 9-yr ~7/14.

Market Analysis (Charts courtesy of QCharts)

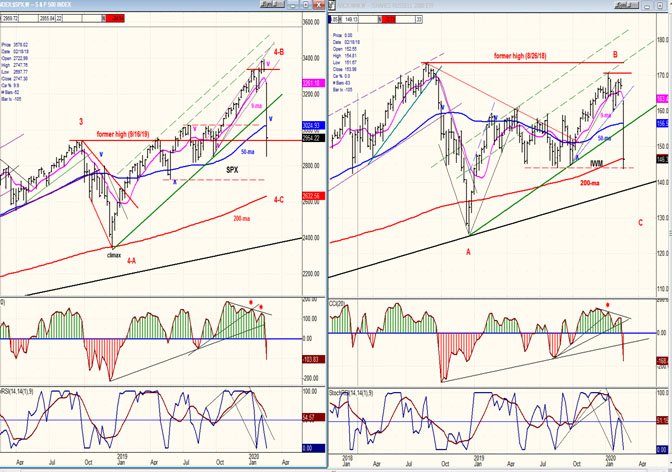

SPX-IWM weekly charts:

Comparing these two charts is proving to be rewarding. The premise is that IWM gives us a heads up on what the SPX is going to do next. The evidence presented by these two charts side by side is compelling. IWM made its recent high a full six weeks before SPX, thereby suggesting that a correction could be imminent.

A longer term aspect of this illustrationis the domain of EWT experts. By refusing to go beyond its 8/26/18 high, IWM may also have beenwarning that wave 4 was still in play, and that C of 4 is just now getting underway.We’ll have to see what that index suggests as we approach the lows of the correction (probably in mid-July), although early warnings appear to be confined to tops.

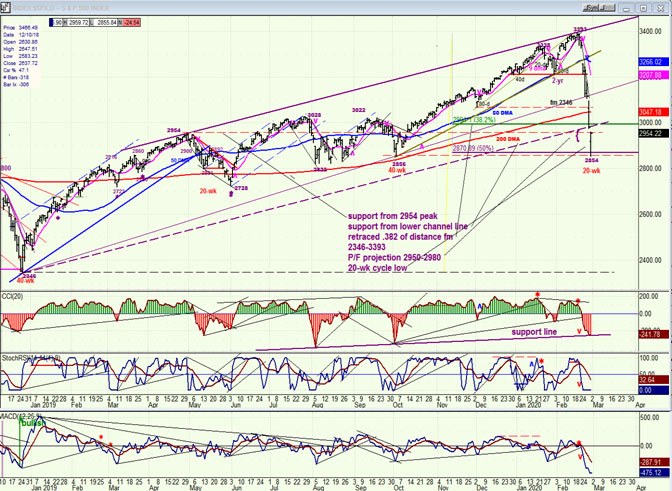

SPX daily chart

On Thursday, I sent the following chart (minus Friday’s data) as part of my evening Market Summary. My reasons for expecting a low near Thursday’s close are given on the chart. I had expected a reversal to occur in this time frame based on the 20-wk cycle low, possibly near the .382 retracement point,but the momentum carried pricessignificantly lower for one more day --a little beyond the .50 retracement level of 2870. Friday’s activity created a 210-point base on the SPX P&F chart, representing a major skirmish between bulls and bearsone day past the ideal date when the 20-wk cycle was scheduled to make its low, with the bulls apparently scoring a decisive victory since the index closed up one hundred points from its daily low, but still down 25 points for the day.

We are about to find out if the stock market still functions in a normal way, whereby cycles, Elliot waves/Fibonacci, and the accumulation/distribution patterns still dictate the market moves, or if the coronavirus epidemic surmounts these historical forces and creates a “new normal”! I suspect that history will prevail and that Friday’s20-wk cycle reversal and the accumulation pattern which formed will create a countertrend rally which retraces .382, or .50 of the ground lost before turning down toward a new low. Already one hundred points of the rally has occurred and what lies ahead should be a continuation of the move to 3061 or 3124. The base which has been created is in two sections and the entire base gives us a count to about ~3125.

SPX hourly chart

The hourly chart shows that in spite of its appearance of panic selling the decline was very orderly, forming a narrow channel which was doubled in width by Friday’s selling climax;but Friday’s close took the indexpastits 9-hr MA and, if this is a valid reversal, itshould continue outside the top channel line early next week. A break of the downtrend line would clinch a short-term buy signal and turn all three oscillators positive.

The blue 50-hr MA is currently at 3175 and should put an end to the rally when it is reached, perhaps atabout 3124. An end to the counter-trend rally should be followed by a resumption of the decline to lower targets, with a minimum projection to 2620, and perhapsby a retracement all the way down to the 2346 December 2018 low.

UUP (dollar ETF)

UUP is pulling back in conjunction with the market sell-off. It’s too soon to tell if this is the effect of the 3-m cycle rolling over. Let’s see how a market rally affects this index.

GDX (gold miners)

GDX found resistance at the mid-point of its intermediate uptrend channel and has pulled back sharply, breaking below the green trend line. This is not expected to be a major set-back, but it could result in a fairly lengthy consolidation that would add to the secondary accumulation pattern already existing.

PAAS (Pan American Silver Corp)

PAAS also reacted sharply to the market sell-off, instead of going against it. It found support on Friday and staged a good rally from its daily low. I would expect a consolidation pattern to start forming as the market rallies from its oversold condition. The long-term uptrend will remain intact unless much more selling occurs, but the stock is expected to remain above its former low of 15.44.

BNO (U.S. Brent Oil fund)

As expected, BNO was vulnerable fundamentally and technically to additional selling, and it took another hit last week. It is now in a well-established down-channel and is likely to stay in it for the foreseeable future. It has good support a point or so lower.

Summary

We have entered a period of uncertainty which could have a significant negative impact on the stock market if the coronavirus infection continues to spread rapidly, not just in China but throughout the rest of the world… Best be cautious until we have more clarity about this situation.

Last week, the market entered an intermediate corrective phase which should last at least until July and see lower prices. Tentative downside targets are given above.

"cycle" - Google News

March 02, 2020 at 07:00AM

https://ift.tt/3cqiGDm

20-week Cycle Low ? - FXStreet

"cycle" - Google News

https://ift.tt/32MWqxP

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "20-week Cycle Low ? - FXStreet"

Post a Comment